nanny tax calculator free

Then print the pay stub right from the calculator. Free Unbiased Reviews Top Picks.

Your household income location filing status and number of personal exemptions.

. If you choose not to enter a tax code the default 1250L will be applied. The Nanny Tax Company has moved. The Nanny Tax Calculator accepts 3 student loan repayment plans ominously they are called.

Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax and payroll service can do for you. Nanny Me Payroll Deductions How To Payroll Deduction Online Calculator. Download a sample nanny contract.

Nanny Payroll Tax Calculator. Ad Find Calculate Nanny Taxes. The NannyPay calculator with forms costs LESS THAN 200year.

Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees. Our tax payment calculator quickly gives you the data you need to file quarterly and at the end of the year. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator.

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord. Use our nanny payroll calculator to help. Cost Calculator for Nanny Employers.

File tax returns year-round. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. As for Social Security and Medicare tax payment 765 will be shouldered by the employer and another 765 will be taken from wages 62 for social security and 145 for Medicare.

The electronic nature is this type of transaction makes sending money via wire transfer fairly hands off requiring you only to know your recipients name bank details and the sum you. Our calculator is the heart of the system. Plan 1 plan 2 and Postgraduate loan.

1250L is the tax code currently used for most people who have one job or pension. Find out how much to pay your nanny. Student loan repayments can also be take into account.

Calculations are approximate and intended for guideline purposes only Nannytax assumes no responsibility for how these calculations are used thereafter. Ad Compare This Years Top 5 Free Payroll Software. Please tick this box if you would like to receive advice and relevant news on employing and.

If you plan to employ your nanny for less than a year the value stated here will. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. This calculator assumes that you pay the nanny for the full year and uses this amount as the basis to calculate what you need to pay per month.

Use our nanny tax calculator to help set your budget. Your exact savings will depend on your household income. Nanny tax calculator for a nanny share.

Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no additional cost. Thats less than everyone else charges per month. These rates are the default rates for employers in Pennsylvania in a locality that does not have local income tax.

What you need to know about wiring money internationally Wiring money internationally is a popular way of sending money abroad. Our new address is 110R South Prospect Ave Park Ridge IL. While the income taxes in California are high the property tax rates are.

One of the best things about being a nanny for a nanny share is that nannies typically make more money working for two families than they would for one. Just enter the hours and everything is calculated for you. These look something like.

The Nanny Tax Company has moved. And because most families use a nanny payroll service handling net gross and direct deposit is all accounted for. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not constitute the provision of tax or legal advice.

Get help from our experts on how to manage your household tax and payroll. Get a Free Consultation. Using a nanny tax calculator.

Because some values depend on the year you must enter both the Pay Period End Date and Gross to. The easiest way for you to estimate your nanny tax obligation is to use a nanny tax calculator. Free nanny tax calculator 2018.

These calculations assume sole employment and that a standard tax code is being used for the Tax Year 2018-19. If the nanny has other employment the results shown will not apply. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Any employee pension payments will be deducted from the net pay you have supplied. Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

Were here to help. Just 29 a year. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not constitute the provision of tax or legal advice.

Most companies will charge you 100 just to prepare a Schedule H making NannyPay an. The user assumes all responsibility and liability for its use. With a nanny tax calculator you can.

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again after this point with the changes detailed in our tax rates and thresholds page. And if you need a sample nanny contract or access to nanny tax forms before your nanny begins working we have these free. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Get your FREE step-by-step guide to managing Nanny Tax Payroll. Nanny taxes see our detailed guide on what nanny taxes are and if you have to pay them Nanny tax payroll service for calculating taxes and providing documentation like paystubs and W-2s. Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll.

Nanny payroll help can vary from low-cost or free DIY resources to full service companies that cost 500-1200year. Typically on a quarterly basis you will need to file state tax returns. Same rules apply for a nanny share.

The user assumes all responsibility and liability for its use. Our new address is 110R South Prospect Ave Park Ridge IL 60068. Calculate What Ive Entered.

Necessary state taxes such as. 273-3356 or feel free to get started online. Computation of Nanny Tax.

Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax.

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Paybooks Is One Of The Best Online Payroll Software System In India Get Access To Webinars E Books And Other Reso Payroll Software Payroll Expense Management

Most Popular Preschool Activities Kids Activities At Home Preschool Learning Activities Preschool Activities

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Gas Mileage Expense Report Template 1 Templates Example Templates Example Mileage Reimbursement Invoice Template Mileage Tracker Printable

4 9 2014 Quickbooks For Contractors Hangout Time Materials Billings Learn To Use Quickbooks In Your Construction Busines Quickbooks Learn Accounting Job

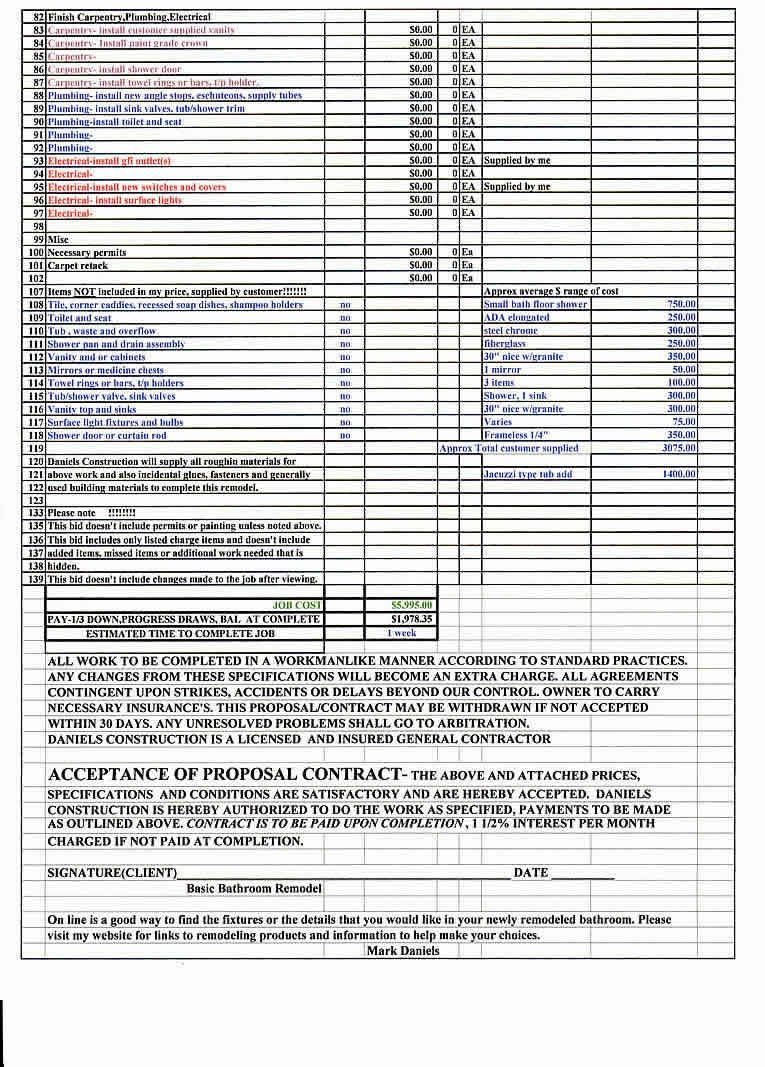

Bathroom Remodel Project Plan Template Elegant Kitchen Remodel Proposal Template Bathroom Remodel Estimate Estimate Template Bathroom Remodel Cost

New Investment Property Calculator Excel Spreadsheet Xlstemplate Xlssample Xls Xlsdata Check More At H Budgeting Worksheets Budget Spreadsheet Excel Budget

This Household Employer S Payroll Tax Checklist Outlines How To Properly Pay Nanny Taxes Read This Guide Today To Better Tax Checklist Nanny Tax Payroll Taxes

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage App Mileage Tracker App

Projected Income Statement Template New Projected In E Statement Template Free Amazing Design Statement Template Mission Statement Template Income Statement

Printable Blank Excel Daily Timesheet Templates Printable Free Timesheet Template Time Sheet Printable

This Household Employer S Payroll Tax Checklist Outlines How To Properly Pay Nanny Taxes Read This Guide Today To Better Tax Checklist Nanny Tax Payroll Taxes

Inventory Sheet Contract Template Cleaning Contracts Inventory Management Templates

Job Estimate Template Estimate Template Invoice Template Quote Template

Nanny Me Payroll Deductions How To Payroll Deduction Online Calculator

Free Payroll Tax Calculator Estimate 2016 Tax Costs Homepay Nanny Tax Payroll Taxes Payroll